The Role of Stablecoins in the Cryptocurrency Market

The cryptocurrency market has been a transformative force in the financial world, offering decentralized alternatives to traditional currencies. However, the market is notoriously volatile, with significant price fluctuations often making it difficult for investors and users to navigate. Enter stablecoins—cryptocurrencies designed to offer price stability by pegging their value to reserve assets such as fiat currencies or commodities like gold. Stablecoins aim to combine the benefits of cryptocurrency (like decentralization and security) with the stability of traditional assets. In this blog, we will explore the different types of stablecoins, their benefits, and their essential role in stabilizing the volatile crypto market.

Section 1: What Are Stablecoins?

Stablecoins are a category of cryptocurrencies that aim to reduce volatility by pegging their value to a stable reserve asset. These assets could include traditional fiat currencies such as the US Dollar (USD), commodities like gold, or even other cryptocurrencies. The key idea is to offer the benefits of digital currencies, such as faster transactions and decentralized systems while maintaining a stable value.

Composition of Stablecoins

A stablecoin typically consists of the following components:

- Pegged Asset: This is the asset to which the stablecoin is tied, ensuring that the coin holds a consistent value. Popular choices include the USD, Euro, or commodities like gold.

- Reserve System: A reserve system is in place to back the value of each stablecoin. An equivalent amount of the pegged asset is held in reserve for every stablecoin issued. For example, a fiat-collateralized stablecoin might hold 1 USD in reserve for every stablecoin in circulation.

- Smart Contracts: These automate processes within certain stablecoins, particularly algorithmic ones, ensuring that supply and demand are balanced to maintain stability.

Stablecoins vs. Volatile Cryptocurrencies

Bitcoin and other traditional cryptocurrencies are characterized by their decentralized nature and limited supply. While offering security and scarcity, these characteristics also lead to considerable price volatility, making them less practical for everyday transactions or as a store of value.

Stablecoins, by contrast, are designed to maintain a fixed value. For example, a USD-backed stablecoin like Tether (USDT) aims to keep its value pegged to $1. This feature makes stablecoins more reliable as a medium of exchange and as a temporary safe haven during market volatility.

Benefits of Stablecoins:

● Stability: As their name suggests, stablecoins offer stability, which is critical in a market often rocked by price swings.

● Accessibility: Stablecoins allow easier access to decentralized finance (DeFi) services for people who may not have a bank account or reside in countries with volatile currencies.

● Efficiency: Stablecoins offer faster, cheaper international payments than traditional banking systems.

Section 2: Types of Stablecoins

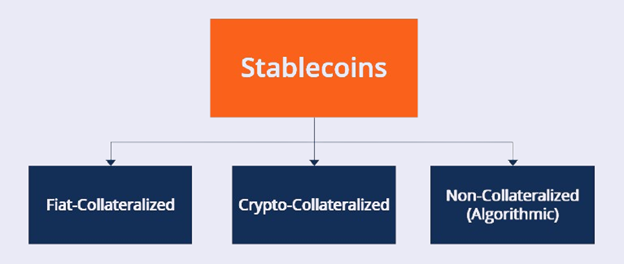

While all stablecoins aim for price stability, they achieve it through different mechanisms. There are three primary types of stablecoins: Fiat-collateralized, Crypto-collateralized, and Algorithmic stablecoins.

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins are backed by traditional fiat currencies, like the US Dollar or Euro, held in reserve by a trusted entity such as a bank or financial institution. For every stablecoin issued, an equivalent amount of the fiat currency is held in reserve, ensuring one-to-one backing.

Examples:

● Tether (USDT): One of the most popular stablecoins, Tether is pegged to the US Dollar and claims to hold a reserve of USD equivalent to the amount of Tether in circulation.

● USD Coin (USDC): Similar to Tether, USDC is another USD-backed stablecoin but is known for having greater transparency, with regular audits of its reserves.

Pros:

● Simplicity: Fiat-collateralized stablecoins are straightforward to understand since they rely on a simple one-to-one peg.

● Reliability: Since traditional currencies back them, they are often seen as more trustworthy.

Cons:

● Centralization: Fiat-backed stablecoins rely on a central authority to manage the reserve, which goes against the decentralized ethos of cryptocurrencies.

● Regulatory Risk: These stablecoins are subject to the same regulations as traditional financial institutions, which can lead to compliance issues.

Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are backed by other cryptocurrencies rather than fiat. These stablecoins are often over-collateralized to account for the volatility of the underlying assets. For example, to issue $100 worth of a crypto-collateralized stablecoin, a user may need to lock up $150 worth of cryptocurrency as collateral.

Example:

● DAI: DAI is a decentralized stablecoin that is pegged to the US Dollar but is collateralized by Ethereum and other cryptocurrencies. Unlike fiat-backed stablecoins, DAI is governed by a decentralized community and maintained through smart contracts on the Ethereum blockchain.

Pros:

● Decentralization: Crypto-collateralized stablecoins do not rely on a central authority, making them more decentralized.

● Transparency: Users can easily verify the collateral backing the stablecoin via blockchain explorers.

Cons:

● Complexity: The mechanisms used to stabilize these coins are often more complex than fiat-backed stablecoins.

● Volatility: Since volatile cryptocurrencies back them, the value of the collateral can fluctuate, requiring over-collateralization.

Algorithmic Stablecoins

Algorithmic stablecoins maintain price stability through algorithms and smart contracts that automatically increase or decrease the stablecoin supply based on market demand. Instead of holding reserves of fiat or crypto, these stablecoins rely on sophisticated mechanisms to balance supply and demand.

Example:

● TerraUSD (UST): TerraUSD was an algorithmic stablecoin designed to maintain parity with the US Dollar through a mechanism involving its sister cryptocurrency, LUNA. However, UST collapsed in 2022 due to market instability, showing the risks inherent in this type of stablecoin.

Pros:

● No Reserves Needed: These stablecoins do not require holding reserves, which can make them more capital-efficient.

● Decentralization: They operate decentralized, with smart contracts managing supply and demand.

Cons:

● High Risk: Algorithmic stablecoins can be vulnerable to collapse if the algorithms fail to maintain the peg, as seen with TerraUSD.

● Complexity: The mechanisms behind these stablecoins can be difficult for users to understand, potentially leading to a lack of trust.

Section 3: Contribution of Stablecoins in Cryptocurrency

Stablecoins play a critical role in the broader cryptocurrency ecosystem by helping to stabilize the market and offering practical use cases in decentralized finance (DeFi), cross-border payments, and remittances.

Stabilizing the Cryptocurrency Market

One of the primary benefits of stablecoins is their ability to stabilize the cryptocurrency market. During periods of high volatility, traders and investors can quickly convert their assets into stablecoins to avoid losses without leaving the cryptocurrency ecosystem. This role has made stablecoins a vital tool for hedging risks, especially during market downturns.

Additionally, stablecoins provide liquidity in the crypto market. They serve as a reliable medium of exchange, enabling traders to move in and out of different cryptocurrencies with ease. Platforms like Gemini offer users a safe and secure environment in which to trade stablecoins and other digital assets.

Cross-Border Payments and Remittances

In decentralized finance (DeFi), stablecoins provide liquidity for decentralized exchanges, lending platforms, and other financial services. For example, users can deposit stablecoins into lending platforms like Aave or Compound to earn interest. Stablecoins allow participants to earn predictable returns through staking or yield farming without exposure to volatile assets.

When it comes to cross-border remittances, stablecoins offer faster and cheaper alternatives to traditional money transfer services. Because stablecoins can be transferred over blockchain networks, they significantly reduce the cost of sending money internationally. For example, someone in the US can send USD-backed stablecoins to a recipient in another country, who can then exchange them for local currency or hold them as a store of value. Using NordVPN (Black Friday Deal: 74% off + 3 months extra, starting at $2.99 from October 16 - December 2) when making such transactions adds an extra layer of protection, ensuring that personal data and transaction details are secure.

Conclusion

Stablecoins have become an indispensable part of the cryptocurrency ecosystem, providing stability, liquidity, and efficiency. They offer users the best of both worlds by bridging the gap between traditional finance and decentralized systems. From hedging against market volatility to enabling smooth cross-border payments, stablecoins are reshaping how we use and perceive digital currencies.

It's crucial to use trustworthy services for safety when utilizing stablecoins. Use Ledger or Trezor for secure storage, NordVPN to protect your online transactions, ProtonMail for secure emails, and Gemini for trading. With these tools, you can confidently manage your cryptocurrency, knowing your assets and transactions are safe.

Stay Tuned

The best articles, links, and news delivered once a week to your inbox.